What is a:

“Million Dollar Baby” and why it mattersWhy Start Early:

Power of compound growth explained simply

What You’ll Need:

Step-by-step checklist for parents

Tax-Free Secrets:

Intro to how the plan avoids taxes legally

Next Steps:

Book your free planning call

👇 Set your appointment today 👇

CLICK BELOW TO WATCH FIRST!

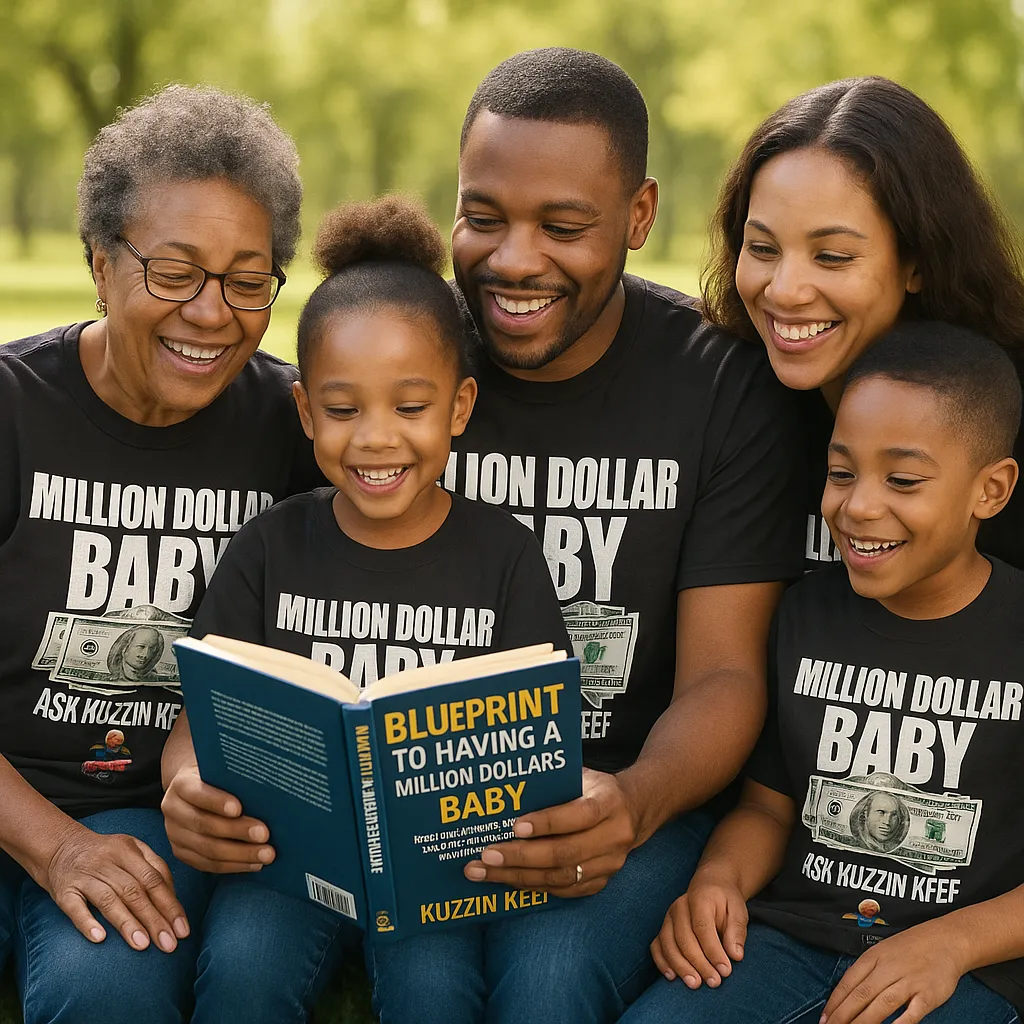

Want to give your child a $1M head start?

Download your FREE Million Dollar Baby Blueprint and learn how parents are building real wealth for their kids — tax-free, stress-free, and smarter than a savings account.

💰Turn $25/week into $1,000,000

— Small, consistent deposits build big futures

📈Grows tax-free — Your money compounds without taxes slowing it down

🛡️Protected from market crashes — Steady growth with no stock market risk

🎓Access funds when needed — College, business, first home, or retirement

👶Locks in lifetime insurance — Start early while they’re young and healthy

🔒Private and probate-free— Wealth transfers directly to your family

❤️Builds generational wealth

— Leave a legacy of love, not just memories

TESTIMONIALS

What others are saying

"Single Mom"

“I never thought I could leave anything behind for my son… but this plan made it real. I started with $100/month, and now I know he’ll have a legacy even if I’m not around. Thank you,

Kuzzin Keef!”

– Tasha B., Atlanta, GA

"Grandparent"

“When I found out I could help my granddaughter become a millionaire with just $3 a day, I jumped on it. This is the best gift I’ve ever given.”

– Robert J., Houston, TX

"Faith-Based Family"

“This plan lined up perfectly with our values. It’s about stewardship and preparing our children to be lenders, not borrowers. We’re building legacy on purpose now.”

– DeShawn & Monique W., Orlando, FL

Frequently Asked Questions

1. What is the “Million Dollar Baby” strategy?

It’s a smart way to create a million-dollar legacy for your child or grandchild using a properly structured Indexed Universal Life (IUL) insurance policy that grows tax-free, provides protection, and builds wealth over time.

2. How much does it cost to start?

You can start for as little as $50 to $100 a month, depending on the child’s age and your long-term goals. The earlier you start, the more powerful the compounding effect.

3. Is this life insurance or a savings plan?

It’s both. An IUL is a permanent life insurance policy that also builds cash value, which grows tax-deferred and can be accessed tax-free for education, a home, or even retirement.

4. Why not just use a 529 college savings plan?

Unlike a 529 plan, the IUL gives your child flexibility. The money can be used for anything, not just education and it won’t count against financial aid eligibility. Plus, the cash value can continue growing for life.

5. What if I die or can’t keep paying?

The policy is backed by the insurance company. If something happens to you, your child is still protected, and options exist to continue funding the policy through its own growth.

6. What makes this better than a regular savings account?

A savings account might earn 1% or less. An IUL can track market indexes and earn up to 9–12%, all while protecting your money from losses due to market downturns.

7. Can the child access the money later?

Yes — when structured right, the child can access tax-free income later in life for college, buying a home, starting a business, or even retirement income.

8. Is there any risk of losing money?

No. An IUL offers downside protection, meaning your cash value never goes backward due to market losses — unlike stocks or mutual funds.

9. What happens if the child passes away?

The life insurance benefit pays out tax-free to the designated beneficiary, creating a lasting financial legacy — even in the worst-case scenario.

10. How do I get started?

Book a free consultation with our licensed advisor. We’ll walk you through a customized plan based on your budget and family goals — no pressure, no obligation.

🛠️ How to Get Started (It's Simple!)

Schedule a Free Million Dollar Baby Session:

We’ll show you a custom plan based on your child’s age and your budget.

Review the Strategy:

We'll walk through exactly how the money grows, when it becomes available, and how to maximize it.

Set It and Forget It:

Once your policy is set up, time and consistency do the heavy lifting.

✅ No complicated investing.

✅ No guessing games.

✅ Just one smart move for your family’s future.

🎯 Next Steps: Let’s Create Your Family’s Legacy

Your child’s future is too important to leave to chance.

The best time to start was yesterday — the next best time is now.

👉Click below to schedule your FREE Million Dollar Baby Planning Session!

[🔵 Book Your Free Session Now!]

Secure the future they deserve — with love, wisdom, and action today.

Copyright © 2025 KJ Financial Group. All rights reserved.

For educational purposes only. Consult a licensed professional for financial advice specific to your situation.